|

Dear Friends,

Families deserve a simple and fair tax system – one that promotes new and better paying jobs for Arkansans and Americans.

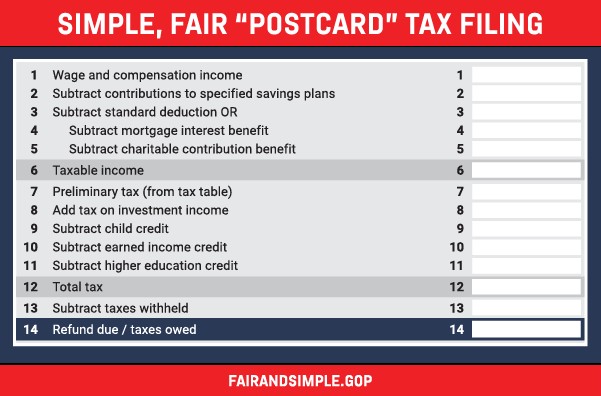

We’re one step closer to reforming our broken tax code by rolling out our tax reform bill called the Tax Cuts and Jobs Act. After years of a growing complex and broken tax system, this proposal simplifies our tax code to help Americans spend less time filing and paying taxes and more time doing the things that matter. This new tax plan helps to eliminate loopholes, bailouts, and handouts. Watch video here.

We want all Americans to prosper and have financial security. The hard-working American family benefits from this simpler and fairer tax plan in a number of ways. Our tax reform proposal aims to reduce tax rates for everyone, and roughly doubles the standard deduction – protecting the first $24,000 of your family’s take-home from taxes. These new reforms provide much-needed support to American families who today are struggling to keep up with the rising costs of child care and higher education, as well as looking after their loved ones. We want to make our tax system simple as filling out a postcard.

Job creators will finally have a tax code system that encourages the growth and success of their businesses, not hinder their development. The Tax Cuts and Jobs Act will lower the taxes on businesses of all sizes to the lowest rates on pass-through business income since before World War II. Our tax plan provides efficient, and effective reforms that benefit the deserving hard-working American family. Once this new tax code is in place, Americans will enjoy a tax system that is simpler and puts more money in your wallets.

To read the Tax Cuts and Jobs Act and get the latest information on our tax plan, text “TAX REFORM” to 50589.

CHIP and Community Health Centers

Communities across Arkansas and America depend on programs that help provide access to vital, high-quality health care for our children. On Friday, I was pleased to support Children’s Health Insurance Programs (CHIP) and other public health priorities, like extensions for funding Community Health Centers.

This legislation is paid for while at the same time helps to modernize and strengthen Medicaid, lowers health care premiums, redirects dollars to proven public health programs, and ensures that those most vulnerable and most in need of care get the help they need. I’m pleased that we have worked in a bipartisan manner in the House to pass this bill that helps provide our communities with access to reliable health care services.

As aways, thank you for allowing me to represent you here in Congress, and thank you for reading my updates on the work my staff and I are doing on your behalf.

Sincerely,

Representative French Hill |

Recently, I have heard from many of you that the post office in the Heights Neighborhood of Little Rock has come under lease negotiations. I have written to the U.S. Postal Service and have shared with them your comments about the important role this facility plays in your daily lives and how vital it is to continue these services.

|

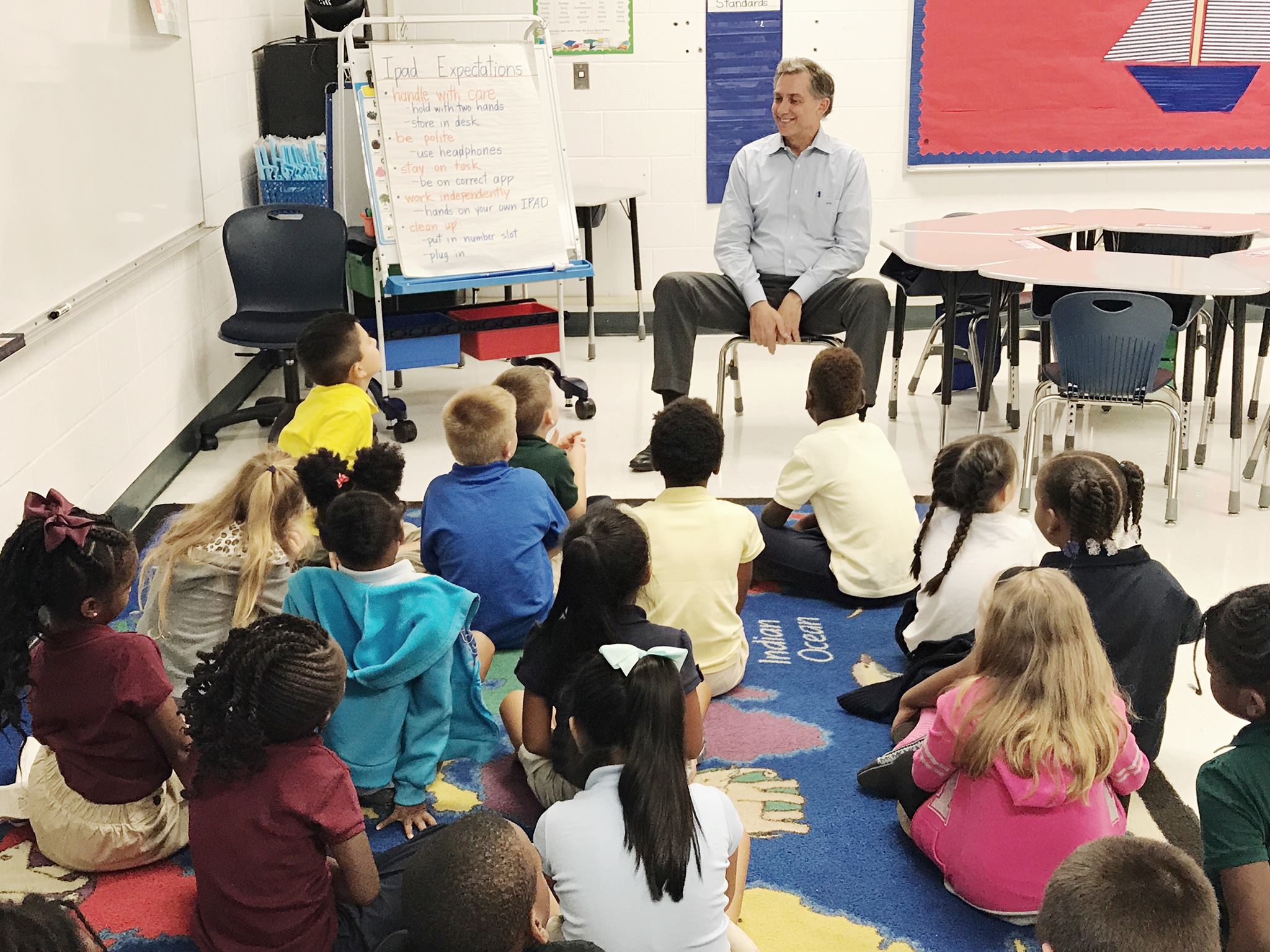

Thank you University of Central Arkansas for inviting me to visit with you. Had a great conversation with Pi Sigma Alpha students about student debt, tax reform, and health care.

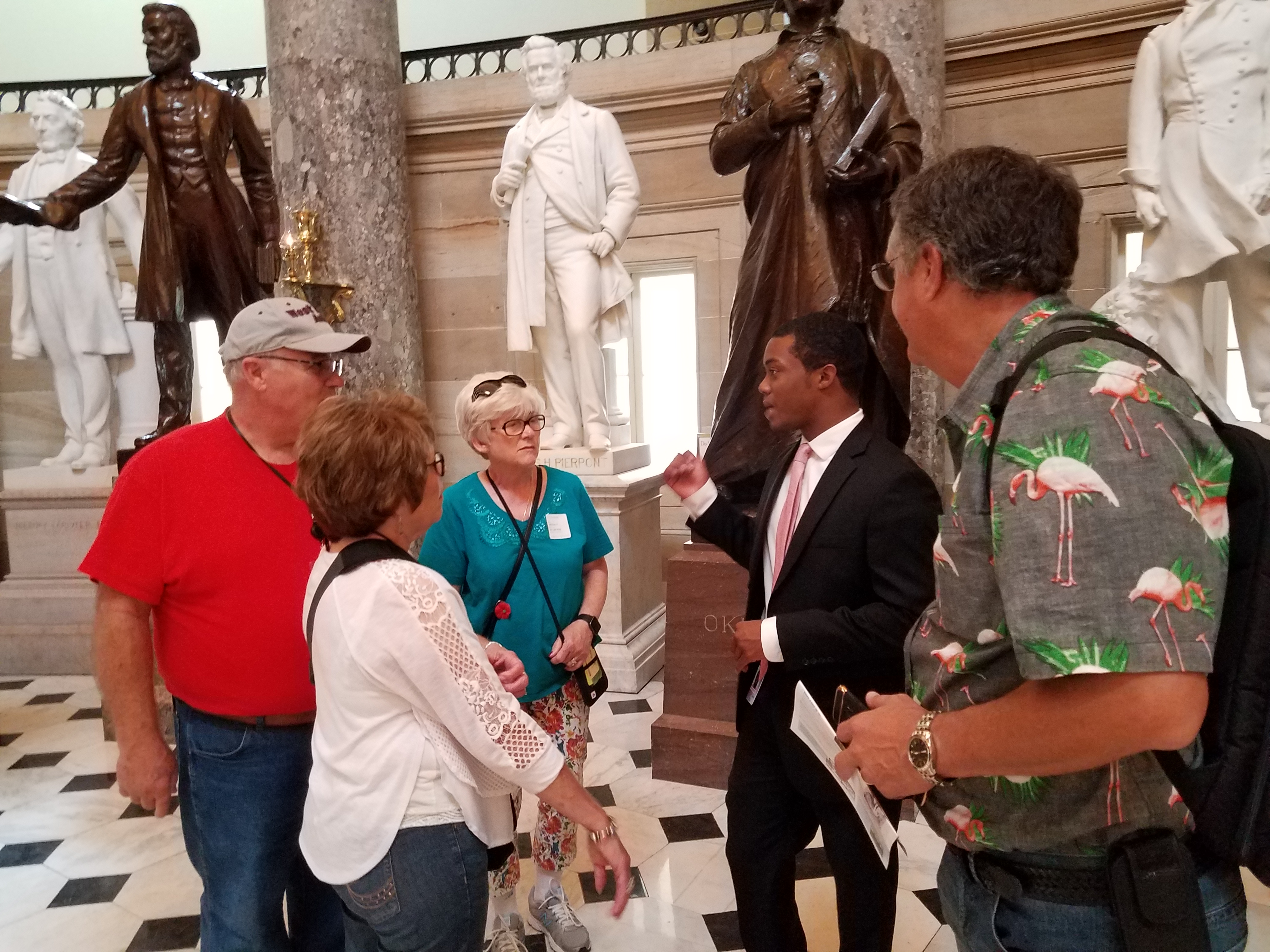

Thinking about visiting our nation’s capital? We would be honored to give you a tour of the U.S. Capitol! Please contact me at (202) 225-2506 to set up a visit to the U.S. Capitol or to another of our nation’s cherished sites in Washington, D.C.

By: Rep. French Hill

October 30, 2017

Thirty-one years ago, Ronald Reagan signed the Tax Reform Act of 1986 into law, which lowered tax rates and closed gaps in the American tax system.

President Reagan was able to achieve successful and constructive tax reforms because lawmakers created a system with bipartisan support. Now, after many years, we must once again review our tax code, filter out unnecessary regulations and make the system accommodating for all.

I am optimistic that we, too, like Reagan, can deliver a simpler, fairer tax system for hardworking Americans.

Last month, we in Congress worked with the White House to release a unified framework for tax reform. My colleagues and I took the first step in constructing this reform package by passing a Concurrent Budget Resolution. By passing a budget, we are now able to begin the hard work that will allow us to create a tax plan that will provide more jobs, fairer taxes, and bigger paychecks.

Impact on Individuals and Families

The burdens and complexities of our current tax code come at a real cost to hardworking families. Since 1986, Congress and government agencies have eroded most of the tax benefits that President Reagan's plan extended for families by adding at least one new tax regulation per day. Our current tax code has swollen to more than 70,000 pages, requiring Americans to spend over 6 billion hours and $168 billion annually to file their returns. The proposed framework delivers a tax code that is simpler for the majority of Americans. It is estimated that approximately nine out of 10 Americans will be able to file on a form as simple as a postcard.

Our framework is focused on delivering relief to middle-class families and those who want to join the middle class. The proposed plan lowers individual rates so families can keep more their hard-earned income to spend, save and invest in our local communities.

The plan also doubles the standard deduction to $12,000 for individuals and $24,000 for families. By doubling the standard deduction, most low-and-middle income Americans will see twice the amount of their paychecks protected from taxes. More of their income will be in the zero tax brackets.

The more we cut taxes, the more money Americans will have in their pockets to pour back into the economy, spurring on our economic growth and prosperity.

Impact on Job Creators

We must convince job creators and business owners to stay here in America. Currently, the United States has the highest corporate tax rate in the developed world. This drives American businesses and jobs overseas. Other nations have recently lowered their corporate tax rates, and America needs to follow if "Made in America" products will continue setting the example of quality and innovation across the globe. We must be more competitive in the global market.

Our proposal will not only grow the economy and create millions of jobs by attracting more investments in America; it will also allow businesses to retain incomes for better pay and benefits for their employees. The proposed framework would drastically lower tax rates for American businesses of all sizes – 20 percent for corporations and no more than 25 percent to main street businesses. Instead of sending large amounts of their business revenue to Washington — money that could go toward building their business and creating new jobs — our proposals encourages them to reinvest in their companies and communities.

Today, small and closely held businesses create roughly half of all jobs in the United States. Yet, these businesses are currently taxed at rates as high as 44.6 percent. Starting and sustaining a small business in America is difficult enough. Our broken tax code only makes it harder by forcing main street job creators to send too much of their income to Washington. Our plan drastically lowers tax rates for these main street businesses from more than 40 percent to 25 percent, which will help create jobs in every community across our country.

Call to Action

We always will face barriers, but those should motivate us, not discourage us. We must make good on our promise to hardworking American people to deliver a tax system that works for all. Reagan, with a Democrat-controlled House, pushed through and worked to accomplish much-needed tax reform. And we will do the same.

Nothing worth fighting for comes easy, and I hope my friends across the aisle will work with Republicans in a bipartisan fashion to deliver a tax system that provides Americans with the relief and hope they deserve.

Click HERE to read the op-ed.

|

|

|

|

|

|