Dear Friends,

Thirty-one years ago, President Ronald Reagan signed tax reform into law. Since then, our tax code has become so big and so broken that now it is discouraging job creation and investment and weighing down our economy. It is blocking hardworking Arkansans and Americans from getting ahead and hurting our small businesses.

I support a tax code that lets Arkansans and Americans keep more of what they have earned. We need a tax code that is simpler, flatter, and fairer – a tax code that lets businesses grow and expand to create jobs and support families.

My good friend, Rachael Cox, showed me around Conway Machine and Bison Pumps, and we talked about simplifying our tax code to help our local manufacturers be more competitive at home and abroad. To watch, click HERE.

In Conway, I visited with Louis and Steve Shrekenhofer, owners of family-run Leather Brothers. They shared with me their frustration with our outdated tax system. As job creators and successful small business owners, they want to see a tax system that is pro-growth and pro-business and that works for them and the community they serve.

Today’s burdensome U.S. tax code makes our businesses less competitive around the world. And when your businesses, workers, and “Made in America” products cannot compete and win globally, the result is fewer jobs, smaller paychecks, and less economic growth here at home.

The Committee on Ways and Means has held a series of public hearings focused on how to make our tax system work better for the American people. So far, these hearings have examined the challenges facing American businesses and workers in the global tax environment, tax-related challenges facing families and small businesses, and Member-driven solutions that would transform our tax code.

Today, small and closely held businesses create roughly half of all jobs in the United States. Yet, these businesses are currently taxed at rates as high as 44.6 percent. Starting and sustaining a small business in America is difficult enough. Our broken tax code only makes it harder by forcing Main Street job creators to send too much of their income to Washington.

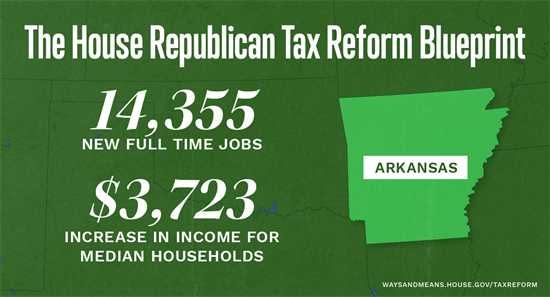

The House’s tax reform package will be simpler, flatter, and fairer, and it will let businesses grow and expand to create jobs and support families. It will let Arkansans and Americans keep more of what they have earned.

✔ More job opportunities

✔ Bigger paychecks

✔ Lowest tax rates in modern history

✔ Greater financial security

Doing your taxes should be as simple as filling out a postcard. The burdens and complexities of our current broken tax code comes at a real cost to Arkansans and Americans all over our country. Independent estimates show that taxpayers spend a combined $99 BILLION each year complying with the individual income tax – money families could otherwise use on what is important to them.

We're working in Congress to reform our tax code so it promotes economic growth and opportunity for all people. I'm am proud of the work Chairman Kevin Brady and the House Ways and Means Committee is doing to fight for these improvements. Visit them at waysandmeans.house.gov.

Sincerely,

Representative French Hill |