|

Dear Friends,

My vote for the House’s tax reform package Thursday was a vote to return to Arkansas families the dollars they have worked so hard for so that they can support their families, their communities, and their futures – all while creating new jobs and bringing jobs back home.

Click HERE to watch my floor speech on historic tax preservation.

For many families, the simplified tax code will eliminate the hours and dollars wasted on tax preparation that will be better spent on educating Arkansas’s children, creating and sustaining jobs, and enriching lives across the state. Arkansans will see more money in their paychecks through a standard deduction that has been doubled.

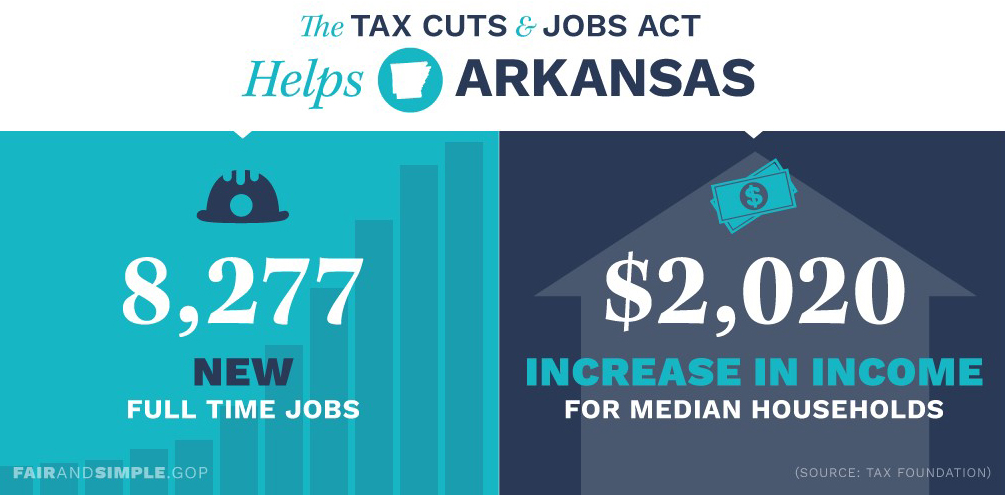

A typical hardworking Arkansas family will be able to keep an additional $2,020 of their income and according to the Tax Foundation our tax plan will create 8,277 new full-time jobs in Arkansas. And, with the child tax credits moving from $1,000 to $1,600, this means more money for the 52,530 Central Arkansas families currently claiming the credit.

For our Arkansas entrepreneurs and small business owners, this bill creates small business tax rates under 25 percent - the lowest tax rate on small businesses since World War II. This is a significant reduction from today’s rates, which will help Central Arkansas job creators grow and expand their businesses. And, for over 6,000 taxpayers in my district who have been hit by the Alternative Minimum Tax, this bill eliminates it.

In addition, by lowering our corporate tax rates and ending double taxation on foreign earnings of American businesses, more money will be flowing into our country with businesses and investment returning home – with the potential to create even more jobs in our state and country.

Please let me know your thoughts on tax reform by completing this survey. Click HERE.

Families deserve a simple and fair tax system – one that promotes new and better paying jobs. I look forward to working with my Senate colleagues to give hardworking Arkansans and Americans hope and relief with a tax code they deserve.

Learn more here about the House bill, the Tax Cuts and Jobs Act. Now the debate turns to the Senate.

A very Happy Thanksgiving to you and your family!

Sincerely,

Representative French Hill |

This week, I had the men, women, and families of Little Rock Air Force Base and Camp Robinson in mind when I voted to fund our military, including critical defense funding that boosts our Arkansas military's readiness and gives them a much-deserved 2.4 percent pay increase. For years in a row, Congress has never failed to consider and pass a defense authorization bill - this year was no exception. This measure now goes to President Trump for his approval.

Pleased to welcome Major General Mark Berry, Adjutant General of the Arkansas National Guard, and his staff to Washington. We discussed the quick response by the Arkansas guardsmen after Hurricane Irma and Maria and the progress of cyber missions and Camp Robinson's training mission.

|

|

Enjoyed my visit with the Puerto Rico House of Representatives Minority Leader and former Ways and Means Committee Chair, Rafael Hernandez Montanez, to discuss the devastation of their island and ensure accountability of U.S. assistance. We also talked about the need for changes in the pending tax legislation in order to help their commonwealth by encouraging job growth and development.

|

|

|

|

|

|